how to answer are you exempt from federal withholding

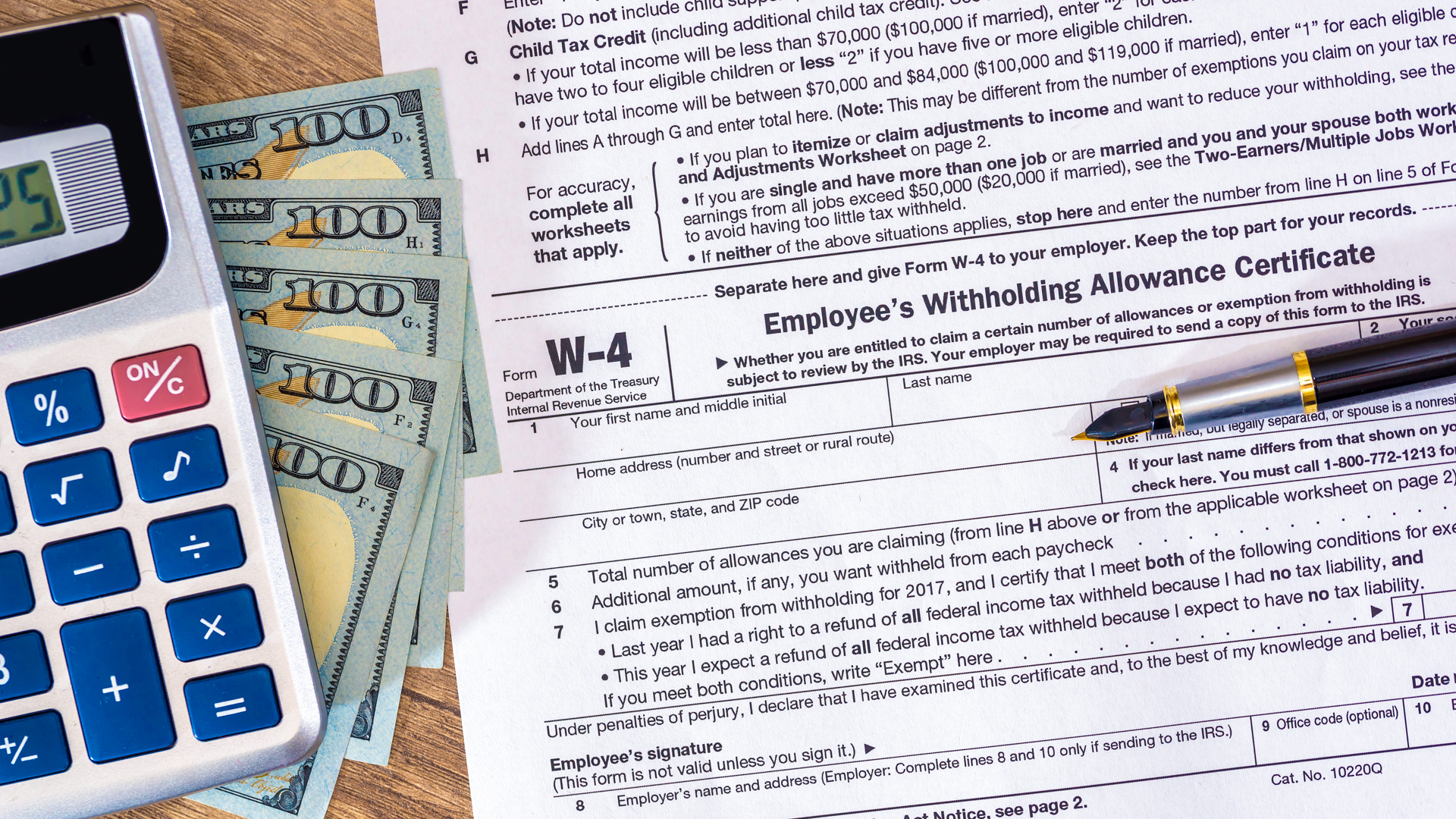

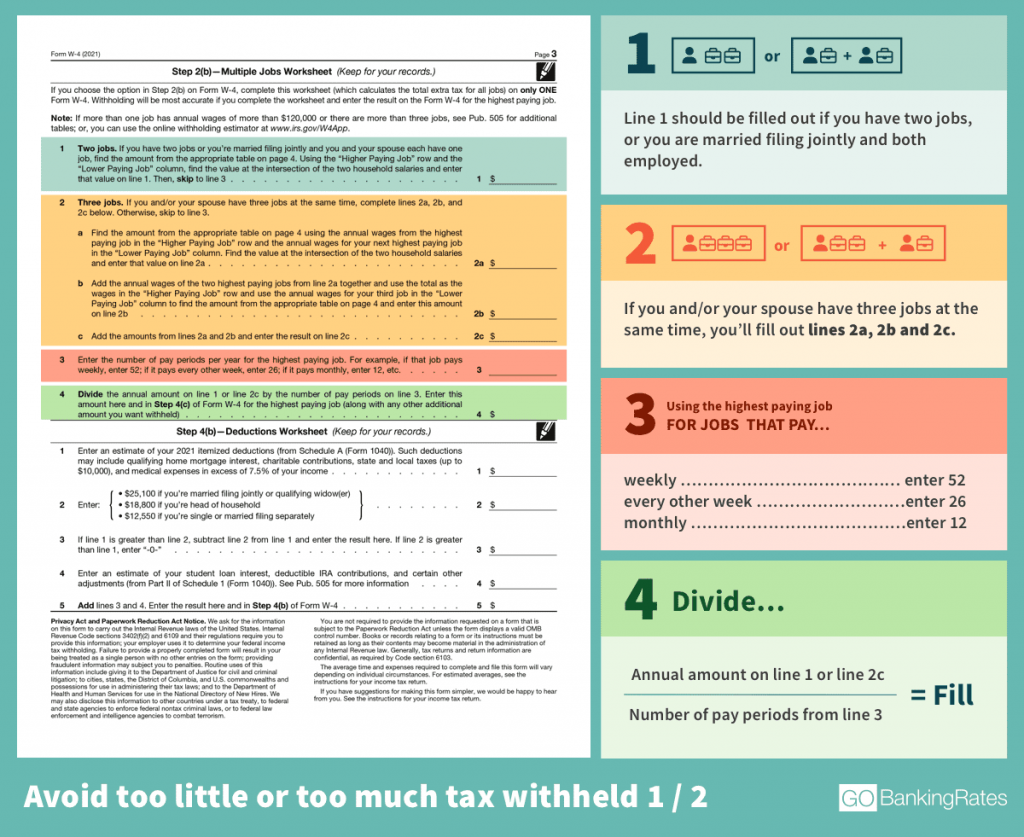

Am I Exempt From Federal Withholding Do I Still Get A Refund Gobankingrates W 4 Form How To Fill It Out In. Select Payroll Info and then select Taxes.

How To Fill Out A W 4 A Complete Guide Gobankingrates

In some cases you may be able to claim to be exempt from federal withholding.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

. Information Youll Need Information about your prior year income a copy of your return if you filed one. You will likely expect to owe no federal tax in 2020 and you wont have to file a federal income tax return if your income is below the filing requirement for your age. If your income can be canceled out by allowable tax deductions leaving you with no tax liability you can elect to be exempt from federal withholding said Ben Watson a certified public.

You owed no federal tax in 2019 and. 2019 Prior Form W-4 Employees Withholding Allowance Certificate. The form isnt valid until you sign it.

You expect to owe no federal income. If you are shown as exempt from federal taxes it means your employer does not withhold any federal tax from your paycheck. If you are exempt from withholding you are exempt from federal withholding for income tax.

Per the IRS for 2022 every single filer will get a standard deduction of 12950. Write Exempt in the space below Step 4c Complete Steps 1a 1b and 5. You need to indicate this on your W-4.

To claim exemption employees must. Select the employee you want to exempt. Your tax bill will not be postponed as a result of this.

If you do this your employer wont withhold federal income taxes from your paycheck. Can I claim exemption from withholding. Then complete Steps 1a 1b and 5.

It is possible to do so and many taxpayers do so throughout the year. You can tell your boss how much money to withhold by filling out a W-4 form. So if you feel your income will be less then 12950 for the whole year you can click this button.

An estimate of your income for the current year. You simply write Exempt on Form W-4. In the past as an employer I was required to submit all Forms W-4 that claimed complete exemption from withholding when 200 or more in weekly wages were regularly expected or claimed more than 10 allowances.

Exemption From a Withholding Allowance You can claim the withholding exemption only if you had a right to a refund of all federal income tax withheld in the prior year because you didnt have any tax liability and you expect the same for the current year. If you see a W-4 with the word Exempt you know not to withhold federal income tax from that employees wages. If you can be claimed as a dependent on someone elses tax return you will need an estimate of your.

What this means is that if your income is below 12950 for the year most likely you will not have to pay any taxes. W 4 Form How To Fill It Out In 2022. This means you dont make any federal income tax payments during the year.

You owed no federal income tax in the prior tax year and. Leave the rest of the W-4 blank. Select the State tab and in the Filing Status dropdown.

The answer to this question depends on a few different factors including your income and your filing status. You may use Form W-4 to claim exempt from withholding if you meet the following conditions. Again employees must use Form W-4 to tell you they are tax exempt.

What Does Are You Claiming Full Exemption From Federal Tax Withholding Mean. As of 2018 the standard deduction on federal income taxes is rising to 12000 for single people 18000 for people filing as head of household and 24000 for married. In the Filing Status dropdown select Exempt.

To claim exemption from withholding certify that you meet both of the conditions above by writing Exempt on Form W-4 in the space below Step 4c. Fill out a new Form W-4 to resume withholding federal tax. When you want to claim exemption you must once again file a Form W-4.

2018 Tax Law Changes. How to answer are you exempt from federal withholding Wednesday June 8 2022 Edit. From the Federal tab on the W-4 Form dropdown select the applicable form.

If you claim exemption you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2020 tax return. It may appear appealing to file an exemption on your W-4 form so that you can claim exemption from withholding. Sign and date Form W-4.

Every time you fill out a W-4 you might be wondering Am I exempt from federal withholding To claim exemption you must meet a set of criteria. Perfect answer When you file as exempt from withholding with your employer for federal tax withholding you dont make any federal income tax payments during the year. Remember you only have to fill out the new Form W-4 if you either start a.

The amount owed will be paid during tax season. This interview will help you determine if your wages are exempt from federal income tax withholding. You expect to owe no federal tax in 2020.

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

W 4 Form How To Fill It Out In 2022

Irs Name Change Letter Sample Letter To Irs Free Printable Documents Address The Recipient By Name And State Letter Sample Name Change Business Template

How To Fill Out A W 4 A Complete Guide Gobankingrates

Preparer Training Tax Services Directions Truth

How Do I Know If I Am Exempt From Federal Withholding

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Appendix 13c Income Taxes And The Net Present Value Method Answer Key Provided At The End Income Tax Income Net Income

Cancer Prevention American Institute For Cancer Research

Spendthrift Clause Video Education Level Clause Estate Planning

Am I Exempt From Federal Withholding H R Block

Who Is Exempt From Paying Income Taxes Are Some People Really Exempt From Paying Taxes Howstuffworks

Reporting Foreign Income Eight Tax Tips From The Irs 1 Internal Revenue Service Internal Revenue Service Irs Income

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

A Beautiful Infographic To Share The Similarities And Differences Of Banks And Credit Unions Infographic Credit Union Credit Repair Services Credit Repair

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)